Retire to Poland with Confidence: Essential Tips for Brits Looking to Move

📚 In this series

This collection of articles explores everything British expats and returning Poles need to know about UK pensions and retirement in Poland. From claiming your UK State Pension abroad to understanding tax rules, SIPPs, and double taxation treaties, the series provides clear, practical guidance to help you make confident financial decisions.

TL;DR

Retiring to Poland can be financially attractive, but it requires careful planning. Tax residency, healthcare access, pensions, and currency exposure all need to be considered before you move. The biggest mistakes usually come from relying on outdated assumptions rather than getting advice tailored to your situation.

❓ Can I retire to Poland from the UK?

Yes – you can retire to Poland from the UK, but there are some important considerations:- Residency & visas: Since Brexit, UK citizens need to apply for residency in Poland, typically through a long-term residence permit based on retirement and sufficient financial means.

- Healthcare: You’ll need valid health cover. Legal residents can access Poland’s public healthcare (NFZ), while many retirees also choose private insurance.

- Pensions: Your UK State Pension is payable in Poland and benefits from annual increases. Private pensions may be managed or transferred via international solutions like SIPPs or QROPS.

- Cost of living: Poland is generally more affordable than the UK, especially outside major cities.

- Taxes: The UK–Poland double tax treaty helps avoid paying tax twice, but professional advice ensures your pensions and savings are structured tax-efficiently.

In this post, you’ll learn how to:

- Understand how your UK pensions and investments are taxed in Poland

- Compare Polish inheritance tax with UK inheritance tax

- Avoid double taxation and structure your wealth efficiently

- Secure residency and access healthcare

Why UK Expats Are Retiring to Poland

While Poland doesn’t have a Mediterranean climate, it offers distinct advantages for UK retirees—especially those married to Polish nationals. It is one of the fastest‑growing destinations for UK retirees.Key benefits

- Lower cost of living — pensions typically stretch further than in the UK

- Cultural and family ties — many partners have deep roots in Poland

- Safety — Poland is widely considered a safe and secure place to live

- Residency options — often straightforward for spouses of Polish nationals

>>> Did you know? Over 8,000 Brits already call Poland their home.

Residency & Tax Status: What You Need to Know About Moving to Poland

Residency Rules After Brexit

Since the UK left the EU, British citizens no longer have automatic residency rights in Poland. You must apply for residency via one of the routes below.

1) Residence through a Polish spouse

This is the most straightforward path. If you are married to a Polish citizen, you can apply for a temporary residence card that can lead to permanent residency after a qualifying period.

2) Independent residency

You can also retire to Poland without a Polish spouse by demonstrating that you meet key requirements:

- Proof of regular passive income (e.g., pensions)

- Valid health insurance

- A registered address in Poland

- Clean criminal record

Polish Tax Residency: What It Means

If Poland becomes your centre of vital interests or you otherwise meet residency criteria, you will be treated as a Polish tax resident.

- Your worldwide income becomes taxable in Poland.

- You must declare relevant foreign assets to the Polish tax authorities.

Careful planning helps avoid double taxation and optimises your income structure.

How to Draw Your UK Pension in Poland (and Minimise Tax)

Accessing Your UK Pension in Poland

In the UK, many people use flexi‑access drawdown (FAD) to control how and when they take income.

However, once you move overseas, some UK providers restrict flexible access. Your options may be limited to:

- Buying an annuity

- Taking 100% as a lump sum, which can trigger:

- Likely UK withholding tax, and

- Polish income tax on most or all of the lump sum

UK Pension Taxation in Poland

Poland does not offer a special flat tax regime for foreign pensions (unlike some countries). Pension income is taxed progressively, like regular earned income.

Under the UK–Poland Double Tax Treaty:

- Your UK State Pension is taxable only in Poland when you are Polish tax resident.

- Income from UK private pensions is also taxable only in Poland (UK government service pensions are a separate category and can be taxed in the UK).

Key Tips

Key Tips

- Inform HMRC that you have left the UK using form P85.

- Apply for a UK “No Tax” (NT) tax code so UK providers do not deduct tax at source when Poland has taxing rights.

- Work with a specialist cross‑border financial adviser to structure pension withdrawals tax‑efficiently.

UK State Pension & Poland

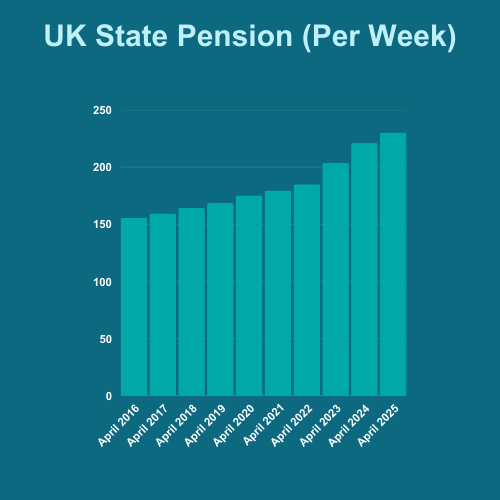

The UK State Pension continues to rise annually for residents in Poland under the current reciprocal arrangements. This ensures your State Pension remains protected against inflation while you live in Poland.

Financial Advice in Poland

Most UK independent financial advisers (IFAs) are not familiar with the pitfalls of living overseas. Furthermore, since Brexit, many UK advisers now decline to work with clients who are resident in the EU.

🔗 How Brexit Changed Financial Advice for UK Expats in the EU

In Poland, the UK-style concept of an independent financial adviser does not really exist; most financial products are distributed via banks and insurance companies.

For the best outcomes, choose an adviser who understands both the UK and Polish systems and can provide joined‑up, cross‑border advice.

Inheritance Tax (IHT): UK vs Poland

Do Brits Still Pay IHT After Moving to Poland?

- UK IHT can still apply to your worldwide assets if, on death, you have spent more than 10 of the last 20 years in the UK.

- Even with less than 10 of the last 20 years in the UK, UK‑situated assets, e.g., property and pensions (from 6 April 2027), remain within the UK IHT net.

- In the UK, IHT is charged on the estate of the deceased. In Poland, the recipient of the inheritance is liable for tax.

- This difference can create a double taxation risk (IHT is not covered by the UK–Poland double tax treaty).

How to Reduce Your IHT Exposure

- Review your UK will and create a Polish will for local assets.

- Use UK gift allowances to transfer wealth early and reduce your estate.

- Consider placing life insurance in trust to help meet future IHT liabilities.

- Work with advisers experienced in UK–Poland cross‑border estates.

Note: Tax rules change, and individual circumstances vary. Seek personalised advice before acting.

Case Study: Retiring to Poland — How Steve & Kasia Structured Their Finances

Background

Steve (60), from Manchester, and Kasia (52), originally from Kraków, are planning to retire to Poland. They want to live closer to family, enjoy a slower pace of life, and help their two children in the UK onto the property ladder.

Financial Overview

- Defined contribution pensions (Steve): £550,000 total across three schemes

- Cash savings: £200,000

- Stocks & Shares ISA: £180,000

- State Pension: Steve due full UK State Pension at 67; Kasia currently has 20 qualifying years

Their Key Challenges

- Structuring Steve’s pensions for flexibility and tax efficiency in Poland

- Deciding what to do with the ISA (not tax-free in Poland)

- Helping their children in the UK without triggering IHT issues

- Managing currency risk between GBP, PLN, and EUR expenses

Their Strategy

- Transfer Steve’s three UK pensions into an International SIPP, giving him control over how and when funds are withdrawn

- Apply for a No Tax (NT) code to receive International SIPP payments without UK tax deducted at source

- Sell ISA investments before taking up Polish tax residency

- Move part of their savings into EUR and PLN-denominated accounts

- Make gifts to their children and put a life insurance policy in trust to offset future IHT exposure

- Arrange voluntary UK National Insurance Contributions for Kasia to build her State Pension entitlement

Outcome

With support from a cross-border adviser, Steve and Kasia created a tax-efficient income structure, avoided double taxation, and provided for their family without excessive UK inheritance tax.

Thinking of Retiring in Poland?

Download my FREE checklist

Make your move stress‑free with our free Retiring in Poland Checklist. Clear steps, no fluff – just what you need to plan with confidence.

Further Reading

🔗 How to Claim UK State Pension in Poland

🔗 Can I transfer my UK pension to Poland?

🔗 How do I apply for an NT Code for pension income? An expat guide

Moving to Poland as a UK Retiree

FAQs

Yes—but they’re no longer tax-free. Any income or gains are taxable under Polish rules. In addition, you cannot make any further contributions to an ISA if you are no longer UK resident.

No. Thanks to the UK-Poland tax treaty, pensions are only taxable in Poland.

Yes.

It depends. If you rent it out, income is taxable in both countries (but relief is available). You might face UK capital gains tax if you sell after becoming Polish tax resident.

It runs from the 1st of January to the 31st of December.

It depends on your bank. Many UK banks have closed the accounts of EU residents. Consider multi-currency solutions like Wise or Revolut.

Poland offers a lower cost of living compared to the UK, quality healthcare, close proximity to the UK for travel, and a rich cultural life. Many British expats also have personal ties to Poland, such as a Polish spouse, which makes integration easier.

Retirees should open a Polish bank account for daily expenses. To minimise forex costs, services like Wise or Revolut offer better exchange rates than traditional banks. Keeping an eye on GBP/PLN exchange rates can also help optimise transfers.

Major cities like Warsaw, Kraków, and Gdańsk offer vibrant cultural scenes and expat communities. The countryside provides a quieter, more affordable lifestyle. The Baltic coast and Tatra Mountains are great for those who enjoy nature and outdoor activities.

Renting is a flexible and affordable option for expats who want to explore different areas before settling. Buying property can be a good long-term investment, especially as prices are still lower than in Western Europe, but legal advice is recommended before purchasing and there may be restrictions on where you can buy land.

Final Thoughts: Planning a Tax-Efficient Retirement in Poland

Retiring in Poland can offer an affordable, culturally rich, and fulfilling lifestyle—especially for those with family ties.

But to make the most of it, you need to:

✔ Optimise your pension withdrawals

✔ Understand your tax residency and reporting obligations

✔ Plan for inheritance tax exposure in both countries

✔ Manage currency risk

💡 Want Expert Guidance on Your Polish Retirement?

I am a UK-qualified financial adviser and have been living in Warsaw for the past 24 years.

I specialise in helping Brits in Poland get their financial ducks in a row.

Use this link to schedule a call and see how I can help.

Talk to an Expert

Retiring to Poland from the UK can be a fantastic way to enjoy a lower cost of living, vibrant cities and a high standard of healthcare — but it also raises important questions around tax, pensions, currency and long-term planning.

I’m Ross Naylor, a UK-qualified Chartered Financial Planner and Pension Transfer Specialist with nearly 30 years’ experience helping British expats in Poland and across Europe align their pensions, savings and investments with local tax rules and long-term retirement plans.

I firmly believe your location in the world should never be a barrier to expert, impartial and transparent financial advice you can trust.

Whether you’re unsure how your UK pensions and State Pension will be taxed in Poland, how to use the UK–Poland tax treaty, what to do with ISAs and UK property, how to manage currency risk between pounds and złoty, or how Inheritance Tax and estate planning work when you live in Poland, I’ll help you build a clear, confident retirement plan before you make the move — or refine things if you’re already here.

Book a confidential consultation