What Happens to My UK State Pension if I Retire Abroad?

UK State Pension

If you’re planning to retire abroad, it’s essential to understand how your UK state pension will be affected. While you can still receive your pension as an expat, there are important considerations regarding the frozen state pension and whether you’ll benefit from annual increases.

This guide will help you navigate the complexities of receiving a UK state pension overseas, ensuring you make informed decisions about your retirement income.

Did you know? - There are currently over one million British citizens living abroad and receiving the UK State Pension, with around 247,000 of those living in Europe (excluding Ireland).

Can I Still Get My UK State Pension If I Live Abroad?

Yes, you can. The UK State Pension is payable to retirees living overseas.

This means you will still receive your pension payments in your country of residence, as long as you’ve made the necessary National Insurance contributions during your working life.

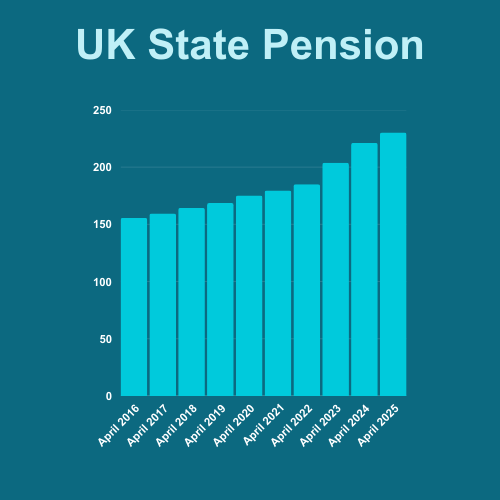

At the time of writing, the full UK State Pension is £221.20 per week, (£11,502.40 per year). It will increase to £230.25 per week from 6th April 2025.

Will My Pension Be Updated for Inflation?

This depends on where you decide to live.

UK State Pensions increase annually in line with the “triple lock,” which means they rise by the highest of the following:

- The rate of inflation

- Average wage growth in the UK

- 2.5%

In recent years, the triple lock has resulted in sizable pension increases. For example, in April 2023, pensions rose by 10.1%.

However, whether you benefit from these annual increases depends on your country of residence:

- If you live in the European Economic Area (EEA), Switzerland, or a country with a reciprocal agreement with the UK: Your pension will increase annually.

- If you live elsewhere: Your pension will be frozen at the rate it was when you first started claiming it.

For example, if you retired to a country like Australia or Canada, your pension payments would not increase with inflation over time. If you

Case Study: The Impact of Pension Freezing

To illustrate the effects of pension freezing, let’s compare the experiences of Mike and Susan, both of whom started receiving the full new UK State Pension in May 2016.

- Mike retired to Thailand, a country without a reciprocal agreement with the UK.

His State Pension was frozen at £155.65 per week (£8,093.80 annually), the rate it was when he first started receiving it.

- Susan retired to Spain, which has a reciprocal agreement with the UK.

Her State Pension increased annually in line with the triple lock.

By 2024, her pension had grown to approximately £221.20 per week, (£11,502.40 annually).

Total Pension Received (May 2016 to December 2024):- Mike: £62,104.35 (frozen at 2016 rate)

- Susan: £74,716.29 (with annual increases)

This gap will continue to grow as Susan’s pension rises annually while Mike’s remains frozen.

This case study highlights how your choice of retirement destination can significantly impact your financial well-being in retirement.

What Are Reciprocal Agreements?

The UK has reciprocal social security agreements with several countries, which allow for annual pension increases.

Some of the countries covered by these agreements include:

- The USA

- New Zealand

- Jamaica

- The Philippines

It’s worth checking whether your chosen retirement destination has a reciprocal agreement with the UK.

How Do I Claim My UK State Pension While Living Abroad?

The process is straightforward. Here’s how to claim your State Pension if you’re retiring abroad:

- Check Your State Pension Age: Ensure you’ve reached the qualifying age to start receiving your pension.

- Contact the International Pension Centre (IPC): You can do this online, by phone, or by post to start your claim.

- Provide Your Details: You’ll need to provide your National Insurance number, proof of your identity, and details of your overseas bank account if you want payments made abroad.

Thinking of Retiring Overseas?

Download my FREE checklist

Make your move stress‑free with our free Retiring Overseas Checklist. Clear steps, no fluff – just what you need to plan with confidence.

Did you know? - If you wanted to buy an annuity that would give you the same income as the full UK state pension, you would need a sum of £250,000.

How Is My Pension Taxed if I Retire Abroad?

You may be taxed on your State Pension by the UK and the country where you live.

If you pay tax twice, you can usually claim tax relief to get all or some of it back.

If the country you live in has a ‘double taxation agreement’ with the UK, you’ll only pay tax on your pension once.

This may be to the UK or the country where you live, depending on that country’s tax agreement.

What If I Haven’t Contributed Enough to Get a Full Pension?

To qualify for the full UK State Pension, you need 35 years of National Insurance contributions.

If you have fewer than 35 years, your pension will be reduced proportionally.

If you’re short on contributions, you might be able to Make Voluntary Contributions.

You can top up your National Insurance record by paying voluntary Class 2 or Class 3 contributions.

Voluntary Class 3 National Insurance contributions cost £17.45 per week in tax year 23/24 and Class 2 rates are £3.45 per week.

Additional Considerations for Retiring Abroad

- Healthcare: Check whether your chosen country offers state-funded healthcare to retirees.

In the EU, you might be eligible for an S1 form to access healthcare.

- Currency Exchange: If your pension is paid into an overseas account, fluctuations in exchange rates could impact your income.

Over the past decade, the GBP/EUR exchange rate has fluctuated between 1.43 and 1.06, significantly impacting the purchasing power of UK retirees in the Eurozone.

- Wills and Estate Planning: Different countries have different inheritance laws.

Review your estate plan to ensure it aligns with local rules.

📚 Further Reading

🔗 Expat State Pension guide (2025/2026 update)

🔗 Expat retirement: Which countries are affected by Frozen State Pension?

🔗 My Big Fat Greek Retirement: A Guide for UK Citizens Looking to Retire to Greece

🔗 Retire to Poland with Confidence: Essential Tips for Brits Looking to Move

💡Final Thoughts

Retiring abroad can be an exciting new chapter, but it requires careful financial planning.

Understanding how your UK State Pension works when you live overseas is a crucial step in securing your retirement income.

Planning ahead will ensure you can enjoy your retirement to the fullest, no matter where in the world you choose to call home.

My Overseas Retirement Roadmap™ service can help you to get your financial ducks in a row, allowing you to enjoy your next chapter with confidence, clarity, and control.

Further info: Expert Financial Advice for People Retiring Abroad

What Happens to My UK State Pension If I Retire Abroad?

FAQs

Yes, you can. The UK State Pension is payable worldwide if you’ve made the necessary National Insurance contributions.

If you live in the EEA, Switzerland, or a country with a reciprocal agreement with the UK, your pension will increase annually. Otherwise, it may be frozen at the level you start receiving it.

These are agreements between the UK and other countries that allow for annual State Pension increases, such as with the EU and the USA.

Contact the International Pension Centre, provide your National Insurance number, proof of identity, and bank details.

It may be taxed by both the UK and the country you reside in, but double taxation agreements can help reduce or eliminate this.

If you have fewer than 35 years of contributions, your pension will be reduced proportionally.

If you have fewer than 10 years of contributions, you won’t receive any state pension.

You can top up your entitlement through voluntary contributions.

If you retire to a country without a reciprocal agreement, your pension may be frozen, meaning it won’t increase with inflation.

In some countries, like those in the EU, retirees may be eligible for state-funded healthcare.

Fluctuations in exchange rates can affect the value of your pension payments if received in a foreign currency.

Yes, different countries have varying inheritance laws.

It’s essential to update your estate plan to comply with local regulations.

Talk to an Expert

For many people, the UK State Pension is a core part of their retirement income — so it’s natural to ask what happens to it if you retire abroad. Will it still be paid? Will it increase each year? How do exchange rates and tax in your new country affect what you actually receive?

I’m Ross Naylor, a UK-qualified Chartered Financial Planner and Pension Transfer Specialist with nearly 30 years’ experience helping British expats understand how their State Pension works when they move overseas, and how to fit it sensibly alongside other pensions, savings and investments.

I firmly believe your location in the world should never be a barrier to expert, impartial and transparent financial advice you can trust.

Whether you’re unsure if your State Pension will be uprated or frozen in your chosen country, how to check your qualifying years, whether to top up gaps, how local tax rules treat UK State Pension income, or how to plan around currency risk, I’ll help you turn a confusing set of rules into a clear, practical retirement plan that works wherever you live.

Book a confidential consultation