How to Save for Retirement as an Expat

Expat Retirement Planning

Planning for retirement is a challenge at the best of times, but for expats, it can be even more complicated.

If you’re living overseas, you will not have access to the same pension and investment options as you did in the UK.

You might also face tax complications and currency risks.

So how do you save for retirement as an expat?

In this guide, we’ll break it down into simple steps to help you build a secure financial future.

Step 1: Understand Your Retirement Goals

Before making any financial decisions, it’s important to have a clear idea of what you want your retirement to look like.

Ask yourself:

- Where do you plan to retire? Will you stay abroad or return to the UK?

- How much money will you need each month to maintain your desired lifestyle in retirement?

- What kind of financial commitments do you have (mortgage, healthcare, family support)?

- What sources of retirement income do you already have in place (rental, pension, investment)?

Cost-of-Living Comparison

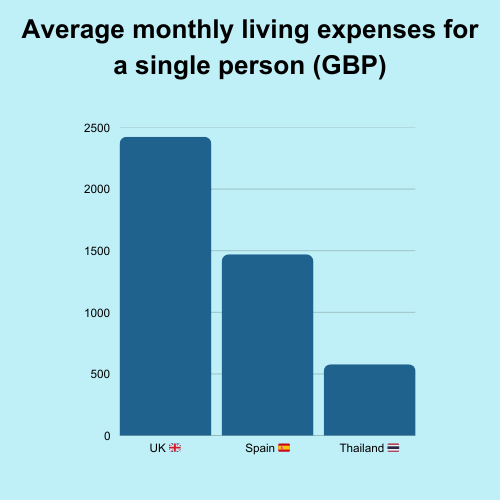

One of the key factors to consider when choosing a retirement destination is the cost of living.

Here’s a comparison of average monthly living expenses in the UK, Spain, and Thailand:

These figures highlight the financial advantages of retiring in countries like Thailand, where the cost of living is substantially lower than in the UK.

However, it’s essential to consider other factors such as healthcare quality, visa regulations, and lifestyle preferences when making your retirement plans.

It is also important to note that in some countries your state pension will be frozen, whereas in others it will continue to increase in line with inflation.

Once you have a clear vision, you can start planning effectively.

Step 2: Make Use of Existing UK Pensions

If you’ve worked in the UK, you likely have existing pension savings.

Even as a non-UK resident, you still have options:

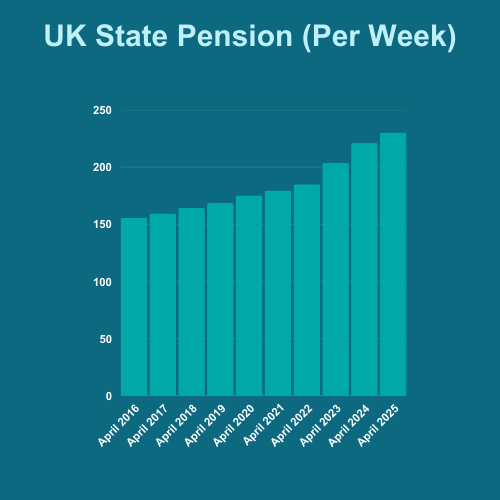

- UK State Pension – You can continue making voluntary National Insurance contributions to increase your entitlement. The full new State Pension amount for 2025/26 is £230.25 per week, but your entitlement will depend on your National Insurance record.

- Workplace Pensions – You may have old workplace pensions that you can consolidate or transfer. According to the Pensions Policy Institute, over £26.6 billion is held in lost UK pensions, so it’s worth tracking yours down.

- Make Pension Contributions – If you have an existing UK pension, you can contribute £3,600 gross per year for the first 5 tax years that you live overseas and still get tax relief.

If you’re unsure about your UK pensions, a specialist expat financial adviser can help you understand your options.

Step 3: Build a Tax-Efficient Investment Portfolio

Many expats choose to save for retirement using investments rather than pensions.

Key considerations include:

- Overseas Pensions – Some countries offer private pension plans similar to those in the UK.

- Tax Efficiency – Different countries tax investments in different ways. Consider tax-friendly investment structures such as offshore bonds or tax-efficient investment accounts.

- Currency Risk – If you plan to retire in a different country from where you are earning, currency fluctuations could impact your savings. Diversifying across currencies can help mitigate this risk.

- Liquidity – Unlike pensions, investment portfolios can provide more flexibility in how and when you access your money.

Case Study: Fiona and Ewan’s Dubai Expat Retirement Plan

Background

Fiona (43) and Ewan (48) moved to Dubai in August 2024 with their two young children.

They are both high-earning professionals benefiting from tax-free salaries.

They plan to stay in the UAE for 5–10 years before returning to the UK.

They have multiple existing pensions with previous employers in the UK and want to understand how best to save for their retirement while living in Dubai.

Key Challenges

- They cannot contribute to UK workplace pensions while living overseas.

- They need a tax-efficient way to save for retirement.

- Their collection of legacy pension plans are hard to manage.

- They must navigate tax risks as they plan to return to the UK.

Recommended Strategy

- Maximise Existing UK Pensions

- Track down all old workplace pensions and consolidate them into a Self-Invested Personal Pension (SIPP) for better control.

- Continue making voluntary National Insurance contributions to maintain their UK State Pension entitlement.

- Contribute £3,600 per annum to their UK pensions for the first 5 years of living in Dubai.

- Build a Tax-Efficient Investment Portfolio

- Invest through low-cost tax-efficient investment platforms that allow for multi-currency investing to mitigate currency risk.

- Diversify investments across multiple asset classes to balance growth and stability.

- Plan for Currency Risk

- Hold a portion of their assets in GBP to align with their long-term return to the UK.

- Plan for Eventual UK Return

- Explore offshore investment bonds, which offer tax-deferred growth and can be structured for efficient withdrawals upon returning to the UK.

- Review Their Plan Annually

- As they approach their return to the UK, adjust their portfolio to optimise for UK tax efficiency.

- Stay informed about changes in tax laws in both Dubai and the UK.

Outcome

By following these steps, Fiona and Ewan can ensure they are saving effectively for their retirement, taking full advantage of their high earnings while minimising tax liabilities.

They will be in a strong financial position when they return to the UK, with a well-structured pension and investment portfolio.

The Bottom Line

Saving for retirement as an expat comes with unique challenges, but with the right strategy, you can build a secure future.

Make use of existing UK pensions, explore international retirement savings options, invest wisely, and stay on top of tax rules.

If you’re unsure where to start, working with an expat financial adviser can help you navigate the complexities and make the most of your retirement savings.

Need advice? Get in touch today to discuss your retirement planning options.

❓ Frequently Asked Questions: Expat Retirement Planning

Can I still contribute to a UK pension if I live abroad?

Yes, you can make voluntary contributions to your UK State Pension and may be able to contribute to private pensions. However, workplace pension access is typically limited while overseas.

How much is the full UK State Pension in 2025/26?

The full new State Pension for the 2025/26 tax year is £230.25 per week, but the amount you receive depends on your National Insurance contribution record.

Will my UK State Pension be frozen if I retire abroad?

That depends on where you live. In some countries, your pension will be frozen, while in others it will continue to rise with inflation. Learn more here.

Can I consolidate my old UK workplace pensions while living overseas?

Yes, you can consolidate them into a Self-Invested Personal Pension (SIPP), which can offer more control and flexibility for expats.

Are there tax-efficient ways for expats to invest?

Yes. Many expats use tax-friendly structures like offshore bonds or multi-currency investment platforms. These can help reduce tax liabilities while investing globally.

What are the risks of currency fluctuations for expat retirees?

Currency risk can impact your savings if you earn in one currency and retire in another. Diversifying across currencies or holding some assets in GBP can help manage this risk.

What should I consider when choosing where to retire?

Cost of living, healthcare quality, visa rules, lifestyle, and how your pension will be taxed or indexed are all critical factors when selecting a retirement destination.

Can I still get UK pension tax relief while living abroad?

Yes, but only for the first five tax years after leaving the UK, during which you can contribute up to £3,600 gross annually and still receive basic rate tax relief.

Are offshore investment bonds suitable for UK expats?

They can be. Offshore bonds allow tax-deferred growth and flexible withdrawals, which may be beneficial depending on your tax residency and long-term plans.

Should I get financial advice for my expat retirement plan?

Absolutely. Retirement planning for expats is complex, especially across multiple tax systems and currencies. A qualified expat financial adviser can help you avoid costly mistakes and optimise your strategy.

Talk to an Expert

Saving for retirement as an expat is very different from saving when you live and work in one country. Multiple currencies, changing tax systems, gaps in National Insurance, employer pensions in different places and offshore investment products can all make it hard to see if you’re really on track.

I’m Ross Naylor, a UK-qualified Chartered Financial Planner and Pension Transfer Specialist with nearly 30 years’ experience helping British expats worldwide build clear, disciplined retirement savings plans that work across borders — not just on paper in one country.

I firmly believe your location in the world should never be a barrier to expert, impartial and transparent financial advice you can trust.

Whether you’re unsure how much you should be saving, which pensions or savings vehicles to use, how to balance UK and overseas pensions, how to invest in a sensible currency mix, or how your expat years affect your future State Pension and tax position, I’ll help you turn a vague retirement idea into a practical, step-by-step plan.

Book a confidential consultation