Should politics influence your retirement plan?

It is hard to avoid politics these days.

Whether it is Brexit, Trump, BLM or the merits of how different governments have responded to the pandemic, the political coverage is relentless.

With widely polarised opinions and 24-hour news reporting, it is natural to wonder whether political considerations belong in your retirement plan.

A recent article in the New York Times looks into just this question.

My key takeaway from the piece is that, as investors, we should resist letting political news cycles influence our retirement planning strategies.

Retirement planning, which doesn’t just stop at our retirement date, is a process that takes decades.

Political winds however are transient. They can shift in a short period of time, often dramatically so.

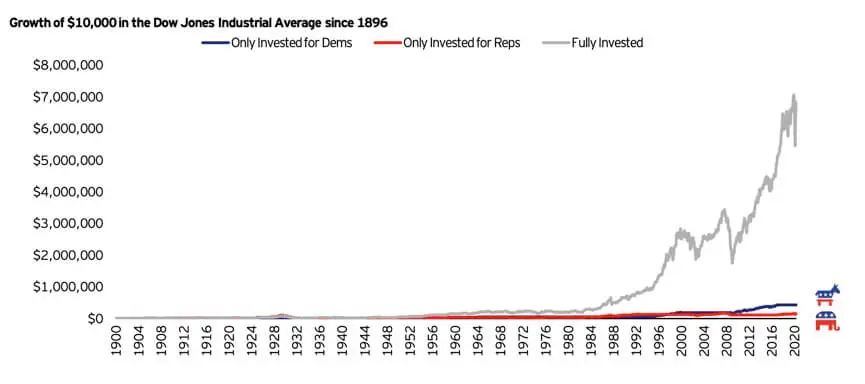

Not only that, but allowing oneself to be influenced by politics can lead to subpar returns. This is shown perfectly in the chart below. You can see that a USD10,000 investment in stocks in 1896 grew to USD7 million by 2020. However, if one were only invested during either Republican or Democratic presidencies, one investments never broke USD1 million.

If you are tempted to let politics influence your financial plans, heed these suggestions from the NYT article that I linked to above.

- If you think politics factor into your [financial] adviser’s strategy for your nest egg, ask for explanations. A good retirement planner will be able to articulate how the actions taken by politicians can — and can’t — affect your portfolio.

- When emotions are running high, resist the urge to dismiss your adviser on the spot — a knee-jerk reaction when it comes to your retirement security isn’t a great idea. Don’t do anything that’s not part of a long-term investing strategy.

- Talk to your adviser about how specific economic policies affect your portfolio. Politics might be about people, but your investment decisions should be informed by the ramifications of, say, bond-buying or tax-code changes.

- Try to keep an open mind. A different viewpoint from one you hold might give you valuable insight for your long-term savings goals.

- If you want to integrate your political views more directly into your retirement planning, some advisers suggest working with someone who has knowledge and expertise in E.S.G. (environmental, social and governance) investing strategy.

In conclusion, the message, which will no doubt sound familiar to long-term followers, is: focus on what you can control, don’t be distracted, and take the long view. Your retirement plan will thank you.

Talk to an Expert

Ross is a qualified Chartered Financial Planner and Pension Transfer Specialist.

He has been a cross-border financial adviser for 25 years and specialises in helping British expats manage their finances with clarity and peace of mind.

If you would like to have a no strings chat with him, please get in touch.