If it is too good to be true… How to learn from past investment scams

🌳 Truffle Trees and Brazilian Teak Plantations

There was a story on the BBC website last week about a couple who invested their pension fund in a firm producing truffle trees; not surprisingly, the story didn’t end happily.

It reminded me of a similar incident involving the equally exotic Quadris Environmental Forestry Fund.

This fund, launched in 2001 and managed by a company called Floresteca, invested in teak plantations in Brazil.

In total, more than £100 million was invested by 1,200 people.

I remember this one well, as it was heavily promoted by another advisory firm here in Poland. Unfortunately, it had a similarly disastrous ending for investors.

Last I heard, the adviser in question still couldn’t figure out why stuffing £7 million of his clients’ money into a fund investing in the Brazilian rainforest was a bad idea.

💸 Lesson from London Capital & Finance: Risk and Return Are Always Related

I’ve been reading a lot about London Capital & Finance (LC&F) recently.

In case you haven’t seen the story, they were a UK investment firm that went into administration a few weeks ago.

They had 11,605 investors who collectively put in £236 million—and who now stand to lose a significant portion of their money. Administrators estimate that some may recover as little as 20% of their savings.

Many of these investors were simply looking for a safe place to put an inheritance or the tax-free lump sum from their pension.

To add insult to injury, they are unlikely to be protected by the Financial Services Compensation Scheme (FSCS).

The investment offered a fixed return of 8% per annum over 3 years—tempting in a world where the Bank of England base rate was 0.75% and most fixed-rate ISAs offered around 2%.

However, investors’ money was placed in mini bonds, which are unregulated, highly illiquid, and carry significant risk.

I don’t necessarily believe this was a clear-cut case of “too good to be true.” The potential return was arguably reasonable given the level of risk—if that risk had been properly understood.

The real issue? Investors were unaware of the actual risks. The product was marketed to people “looking for higher returns than the high street” and was pitched as low risk—comparable to a fixed-rate ISA. It wasn’t.

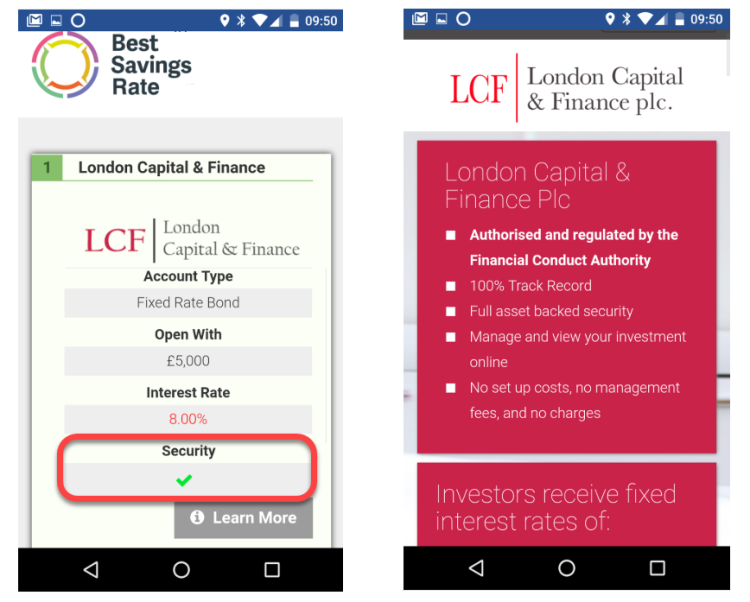

As you can see from the above image, LC&F were aided by a firm of so-called rocket scientists who created a number of “best savings rate” comparison pages (now offline), conveniently showing LC&F as the best deal in town.

Conclusion

The key takeaway here is that we, as investors, need to remember that risk and return are always related.

If an investment is offering a significantly higher return than its peers (with LC&F it was fourfold), then somewhere, the level of risk must be commensurately higher too.

Make sure your pension is invested into a well-diversified portfolio of low-cost index funds — and leave the study of trees to dendrologists.

❓ Frequently Asked Questions

What was the London Capital & Finance (LC&F) scandal?

LC&F was a UK-based investment firm that collapsed in 2019, leaving over 11,000 investors facing major losses. The company sold high-risk mini-bonds as low-risk savings products, misleading investors about the level of risk involved.

Why did LC&F investors lose money?

Investors were misled into thinking their money was safe in a “high street equivalent” product, but their funds were actually placed into unregulated, illiquid mini-bonds. When the company collapsed, most investors were not protected by the Financial Services Compensation Scheme (FSCS).

What are mini-bonds and why are they risky?

Mini-bonds are a form of debt investment issued by companies directly to investors. They are typically unregulated, high-risk, and not covered by FSCS protections. If the issuing company fails, investors may lose most or all of their money.

What happened with the truffle tree and teak plantation investments?

These were exotic, unregulated schemes promoted as sustainable or high-return investments. In reality, they lacked transparency and due diligence. Investors lost millions when the ventures failed to deliver expected returns.

Why do people fall for these types of investment scams?

Scams often offer unusually high returns and present themselves as ethical or exclusive opportunities. Without proper financial advice, people may overlook the risks and invest based on trust, emotions, or marketing tactics.

What can I learn from the LC&F case?

The key lesson is that risk and return are always related. If an investment is offering significantly higher returns than mainstream alternatives, the risk involved must also be higher—even if it’s not obvious at first glance.

How can I avoid bad investments?

Stick to regulated, diversified investment products. Avoid any scheme offering high commissions, vague business models, or promises of guaranteed returns. Always ask for independent, qualified financial advice before committing your money.

Should I be worried about where my pension is invested?

Yes. Your pension should be invested in a diversified, low-cost portfolio—ideally in index funds. Exotic, high-risk schemes have no place in retirement planning unless you’re fully aware of the risk and can afford the loss.

Are exotic environmental funds like forestry schemes ever legitimate?

Some may be genuine, but they often lack proper regulation and transparency. Many have historically been linked to mismanagement or fraud. Always verify the fund’s credentials and regulatory oversight before investing.

What’s the best way to protect my retirement savings?

Work with a qualified, independent financial adviser. Ensure your investments are regulated, diversified, and suitable for your risk profile and retirement goals. Avoid anything that sounds “too good to be true.”

Talk to an Expert

Ross is a qualified Chartered Financial Planner and Pension Transfer Specialist.

He has been a cross-border financial adviser for 25 years and specialises in helping British expats manage their finances with clarity and peace of mind.

If you would like to have a no strings chat with him, please get in touch.