If it is too good to be true… How to learn from past investment scams

Truffle trees and Brazilian teak plantations

There was a story on the BBC website last week about a couple who invested their pension fund in a firm producing truffle trees; not surprisingly, the story didn’t end happily.

The story reminded me of a similar incident involving the equally exotic Quadris Environmental Forestry Fund.

This fund, which was launched in 2001 and was managed by a company called Floresteca, invested into teak plantations in Brazil.

In total, they invested more than GBP100 million from 1,200 people .

I remember this one well, as it was being promoted heavily by another advisory firm here in Poland. Unfortunately it had a similarly disastrous ending for investors.

At the last I heard, the adviser in question still couldn’t figure out why stuffing GBP7 million of his clients’ money into a fund investing in the Brazilian rain forest was a bad idea.

Lesson from London Capital & Finance: risk and return are always related

I’ve been reading a lot about London Capital & Finance (LC&F) recently.

In case you haven’t seen the story, they are a UK investment firm that went into administration a few weeks ago.

They had 11,605 investors who had invested GBP236 million and who now stand to lose a significant part of their money (administrators think they could get as little as 20% of their savings back). Many of these investors were simply looking for a home for an inheritance or the tax free lump sum from their pension.

To add insult to injury, they are unlikely to be covered by the Financial Services Compensation Scheme (FSCS).

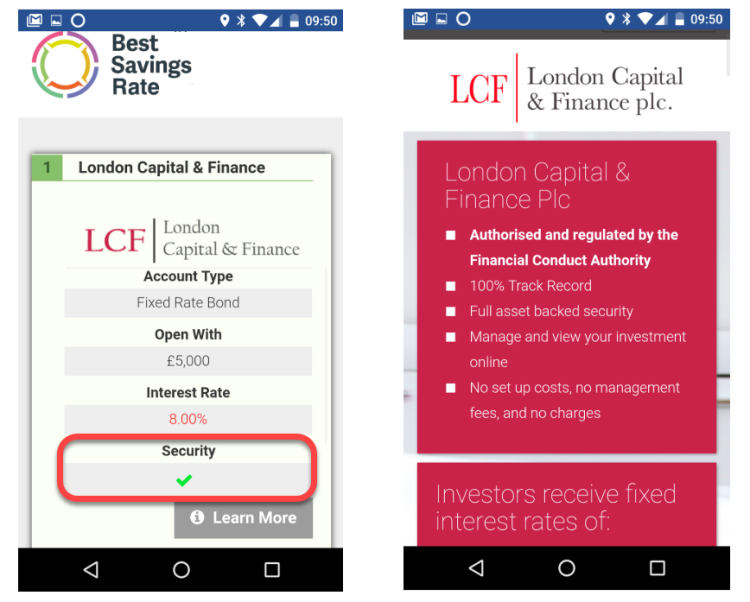

The investment in question offered a fixed return of 8% pa over 3 years which is obviously appealing in a world where the Bank of England base rate is 0.75% and most fixed rate ISAs pay around 2%.

However, the investors money went into mini bonds and there are unregulated, very illiquid and high risk.

I don’t necessarily think that this is simply a case of something being “too good to be true”. The potential return was actually quite reasonable when taking the level of risk involved into account.

The problem is that investors were unaware of the level of risk involved. In fact, the investment was marketed to those “looking for higher returns than the high street”. It was pitched as being low risk and equivalent to a fixed rate ISA.

As you can see from the above image, LC&F were aided by a firm of rocket scientists who created a number of “best savings rate” comparison pages (now offline) showing LC&F as the best deal in town.

Conclusion

The key takeaway here is that we, as investors, need to remember that risk and return are always related.

If an investment is offering a significantly higher return than its peers (with LC&F it was 4 fold) then, somewhere, the level of risk must be commensurately higher too.

Make sure your pension is invested into a well diversified portfolio of low cost index funds and leave the study of trees to dendrologists.

Ross is a qualified Chartered Financial Planner and Pension Transfer Specialist.

He has been a cross-border financial adviser for 25 years and specialises in helping British expats manage their finances with clarity and peace of mind.

If you would like to have a no strings chat with him, please get in touch.