My Big Fat Greek Retirement: A Guide for UK Citizens Looking to Retire to Greece

Retiring to Greece

For many UK citizens, retiring to Greece represents the perfect blend of Mediterranean sunshine, relaxed living, and lower living costs.

But beyond the lifestyle benefits, financial planning, tax efficiency, and pension structuring are critical to ensuring a comfortable and stress-free retirement.

If you are considering making Greece your home in retirement, you need to understand:

✔️ How your UK pensions and investments will be taxed in Greece.

✔️ The impact of Greek inheritance tax vs. UK inheritance tax.

✔️ The 7% flat tax regime for foreign pensioners – and how to qualify.

✔️ How to avoid double taxation and structure your wealth efficiently.

This guide will walk you through the key financial, tax, and estate planning considerations before making the move.

>>> Did you know? Over 17,000 Brits already call Greece their home.

Why UK Expats Are Choosing Greece

While Greece has always been a popular destination for British retirees, expats with sizable pensions and investments stand to gain the most from careful financial planning before relocating.

Here’s why Greece is an attractive option:

✔️ A Favourable Pension Tax Regime – The 7% flat tax on overseas pension income (for the first 15 years) is one of the most attractive pension tax rates in Europe.

✔️ A Lower Cost of Living – While Athens and tourist hotspots like Mykonos can be expensive, many expats find their pension goes further in Greece than in the UK.

✔️ Strong UK-Greece Ties – Regular flights, an active expat community, and reciprocal healthcare agreements make moving to Greece an easy transition for British retirees.

✔️ The Greek “Golden Visa” – If you invest €250,000+ in Greek property, you can obtain residency with the potential to apply for citizenship after seven years.

However, there are critical tax and financial issues to plan for before you relocate.

Residency & Tax Status: What You Need to Know About Retiring in Greece

Since the UK left the EU, UK citizens no longer have automatic residency rights in Greece.

If you’re planning to retire there, you must obtain a residence permit through one of the following routes:

1️⃣ Standard Retirement Visa

This option is available if you can prove sufficient passive income (from pensions, rental income, or investments).

The exact financial requirements can vary, but in general, you should be able to show:

✔️ At least €2,000 per month in passive income (this may be higher for couples).

✔️ Private health insurance coverage.

✔️ A clean criminal record.

2️⃣ The Greek “Golden Visa” – A Fast-Track to Residency

If you’re considering purchasing property, investing €250,000+ in Greek real estate can provide residency for you and your family.

The benefits include:

✔️ Family inclusion – Covers spouses, children under 21, and parents.

✔️ No requirement to live in Greece full-time.

✔️ Schengen Area access – You can travel freely across the EU.

After seven years, Golden Visa holders can apply for Greek citizenship—which, for those considering long-term retirement in Greece, could be a valuable option.

Greek Tax Residency Rules

If you spend more than 183 days per year in Greece, you will be considered a Greek tax resident, meaning:

✔️ You will be liable for tax on worldwide income (unless under a special tax regime).

✔️ You may still be subject to UK inheritance tax (IHT) if you remain UK-domiciled*.

✔️ You must declare foreign assets above €100,000 to Greek tax authorities.

Given the complexity of UK-Greece tax issues, careful financial structuring is essential before relocating.

* From 6th April 2025, the UK is moving to a system based on residence, not domicile.

How to Draw Your UK Pension in Greece (and Minimize Tax)

One of the biggest financial advantages of retiring in Greece is the 7% flat tax rate on foreign pension income.

This regime applies to:

✔️ UK private pensions (SIPPs, QROPS, company pensions).

✔️ UK State Pension.

✔️ Annuities and pension-like income from overseas.

Eligibility for the 7% Pension Tax Regime

To qualify for the 7% flat tax rate, you must:

✔️ Have a foreign pension or pension-like income.

✔️ Not have been a Greek tax resident for 5 of the last 6 years.

✔️ Transfer from a country with a tax treaty with Greece (like the UK).

Key Pension Tax Planning Considerations

❗ Take Your UK 25% Pension Lump Sum Before Moving – Once you become a Greek tax resident, your pension withdrawals are taxed at 7%, including your pension commencement lump sum (PCLS).

❗ Plan your pension withdrawals carefully – Work with a cross-border adviser to structure your pension income efficiently.

❗ Apply for a UK “No Tax Code” – This ensures that HMRC does not deduct tax at source from your pension payments.

Applying for an NT tax code can save UK expats thousands in unnecessary tax deductions.

UK State Pension & Greece

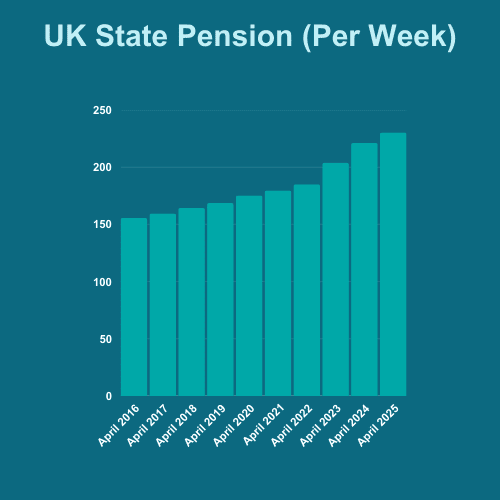

The good news for retirees is that the UK State Pension continues to increase annually for those living in Greece, as part of the reciprocal agreement.

However, you must:

✔️ Inform HMRC about your move.

✔️ Consider currency fluctuation risks.

Greek Inheritance Tax (IHT) vs. UK IHT: Avoiding Double Taxation

A critical aspect of financial planning for retirees is inheritance tax (IHT). Many expats assume that moving abroad removes their UK IHT liability, but this isn’t always true.

✔️ Greek IHT applies to Greek assets (real estate, bank accounts, investments).

✔️ UK IHT still applies if you remain UK-domiciled (typically 40% on estates above £325,000) *.

* UK IHT rules are changing from 6th April 2025 to a residence-based system.

How to Reduce Your IHT Exposure

✔️ Consider holding Greek property in a company/trust structure.

✔️ Review your UK will & create a Greek will to ensure compliance with local laws.

✔️ Use gifting strategies to minimise UK IHT liability.

Using gift allowances to reduce IHT: Six tips on using gifts to reduce inheritance tax

Case Study: Retiring to Greece – How Mike & Elisabeth Optimized Their Finances

Background

Mike (56) and Elisabeth (58) are a mixed-nationality couple planning to retire to Zakynthos, Greece.

Mike, a UK citizen, has spent his career at Shell, completing several senior expat assignments before retiring.

Elisabeth, a Dutch citizen, is fluent in multiple languages and has embraced their new Mediterranean lifestyle.

They have two children in the UK; one at university and the other in their first job.

Mike and Elisabeth want to help them get onto the UK property ladder in the coming years.

After years of careful financial planning, they are financially secure, but they want to ensure their wealth is structured tax-efficiently in Greece and the UK.

Financial Overview

💰 Mike’s QROPS Pension (Malta) – £1,400,000

💰 Cash & Premium Bonds (NS&I) – £300,000

💰 AJ Bell Stocks & Shares ISA – £250,000

💰 Future UK State Pension – Full pension expected at age 67

🔹 Mike drew down his pension commencement lump sum (PCLS) while they were still UK-resident to make sure that it was tax-free.

They used the funds to renovate an old property on Zakynthos, turning it into their dream retirement home.

🔹 They now need to decide how best to draw their remaining QROPS pension and investments to fund their Greek retirement while structuring their finances to minimise tax exposure.

Challenges & Planning Considerations

1️⃣ How to Fund Retirement in Greece

2️⃣ Managing Cross-Border Taxation

3️⃣ What to Do with Their UK Investments (ISA & Premium Bonds)

4️⃣ How to Help Their Children Without Excessive Tax Costs

5️⃣ Currency Risk – Managing GBP vs. EUR

Let’s explore how they navigated these challenges.

1️⃣ How to Fund Retirement in Greece

Key Considerations:

- Mike already took his PCLS, so all future QROPS withdrawals will be fully taxable.

- Greece offers a flat 7% tax on foreign pensions for the first 15 years—an excellent opportunity to draw pension income tax-efficiently.

Strategy:

✔️ Apply for the Greek 7% Pension Tax Regime – By registering as Greek tax residents and opting into this regime, Mike ensures that his QROPS withdrawals are taxed at a flat 7% in Greece instead of higher UK tax rates.

✔️ Withdraw from QROPS Strategically – They set up an annual withdrawal plan, ensuring they:

- Take a stable income from the QROPS while staying within the 7% Greek tax rate.

- Minimise any unnecessary UK tax exposure.

✔️ Avoid Premature UK State Pension Taxation – Since Mike will only claim his UK State Pension at 67, they don’t need to plan for it yet, but they factor it into their long-term income plan.

✔️ Retain Cash Savings – They will keep funds equivalent to 3 years’ worth of expenses in cash and short-term bonds to provide a cushion against stock market volatility.

2️⃣ Managing Cross-Border Taxation

Because they are moving to Greece permanently, tax residency and cross-border taxation must be carefully managed.

🔹 Greek Tax Residency

Since they are living in Greece full-time, they become Greek tax residents after 183 days per year.

🔹 QROPS & the Malta Tax Agreement

Malta has a double tax treaty (DTT) with Greece, allowing Mike to pay only 7% tax in Greece on pension withdrawals, without additional Malta taxation.

🔹 UK Tax Position:

✔ Since Greece and the UK have a double taxation treaty, Mike will avoid being taxed twice on his pension.

✔ Informing HMRC of their tax status is crucial – form P85.

✔ Applying for a “No Tax Code” ensures the UK does not deduct unnecessary tax at source.

Three Tips for Retiring in Greece

I asked a client who recenly retired to Greece about the 3 things he knows now that he wished he had known before he started the process.

Here are his answers:

1. The bureaucracy. The Greeks love stamping documents. Get all possible documents you’ll need like birth certificates, marriage certificates etc., apostilled before you arrive. Even then you’ll probably still need to use an apostle service.

2. Get a good lawyer but make sure they’re experienced in whatever discipline you’re asking. Some lawyers you’d use for real estate are not that experienced in applying for the Golden Visa or Financially Independent visa.

3. Same story with your accountant. You need your annual tax return, you need advice on the DTA and how it works, and also expertise in applying for special tax regimes like the 7% expat pension and offshore income rate.

3️⃣ What to Do with Their UK Investments (ISA & Premium Bonds)

Mike holds £250,000 in a Stocks & Shares ISA and £300,000 in NS&I premium bonds and cash.

🚨 The Issue:

✔️ ISAs lose their tax-free status outside the UK.

✔️ Premium Bonds are also taxable in Greece—unlike in the UK, where winnings are tax-free.

Strategy:

✔️ Sell the ISA Before Leaving the UK – To avoid Greek taxation on ISA gains, Mike sells his Stocks & Shares ISA before becoming a Greek tax resident and reinvests the funds in a structure that will be more tax-efficient for their new life in Greece.

✔️ Reduce Premium Bond Holdings – Since premium bond prizes are taxable in Greece, they move part of this cash into a Euro-denominated account for spending.

4️⃣ Helping Their Children Onto the Property Ladder

One of Mike and Elisabeth’s top priorities is helping their children buy their first homes in the UK.

🚨 The Challenge:

UK Inheritance Tax (IHT) Risk – If Mike remains UK-domiciled, gifts could still be subject to UK IHT if he dies within 7 years.

Strategy:

✔️ Use life insurance – Mike takes out a life insurance policy written in an appropriate trust. The policy would provide a lump sum on death that would be used to pay the resulting IHT bill.

✔️ Using life insurance to mitigate Inheritance Tax

✔️ Use the UK Gift Allowances Going Forward

- Mike can gift £3,000 per year per child tax-free under UK rules.

- Small wedding gifts (£5,000) and regular gifts from income are also tax-free.

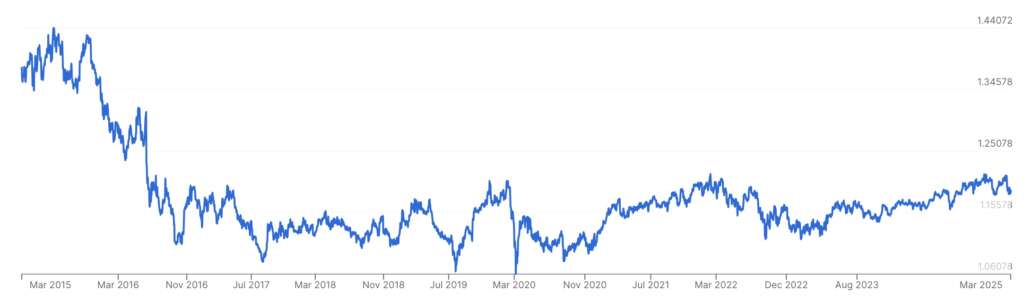

5️⃣ Managing Currency Risk – GBP vs. EUR

Since they are drawing their QROPS in GBP but spending in EUR, currency fluctuations could impact their lifestyle.

✔️ If GBP weakens, their pension buys fewer euros.

✔️ If GBP strengthens, they get more spending power.

Strategy:

✔️ Use Multi-Currency Accounts – Mike and Elisabeth open accounts with Wise, allowing them to hold both GBP & EUR.

✔️ Maintain GBP Holdings for UK Gifts – Since they plan to help their children in the UK, they keep some savings in GBP rather than converting everything to EUR.

Outcome: A Tax-Efficient Retirement in Greece

By structuring their finances correctly, Mike and Elisabeth successfully:

✔️ Minimised Tax on Their QROPS – Paying only 7% in Greece instead of higher UK tax rates.

✔️ Repositioned Investments – Moving out of ISAs and premium bonds to avoid unnecessary Greek taxation.

✔️ Planned Their Gifting Strategy – Helping their children tax-efficiently.

✔️ Hedged Against Currency Risk – Ensuring their pension income remains stable.

Moving to Greece

FAQs

If you have UK ISAs (Stocks & Shares ISAs, Cash ISAs), be aware that they lose their tax-free status in Greece.

🔹 Greek tax law does not recognise ISAs as tax-exempt.

🔹 Any gains or withdrawals may be subject to Greek income and capital gains tax.

🔹 Greek tax rates can be as high as 45% on income and 15% on capital gains.

💡 What to Do Instead?

✔️ Consider offshore investment bonds.

✔️ Review your ISAs before moving—selling before you become a Greek tax resident might be beneficial.

Many UK expats wrongly assume that moving abroad eliminates their UK inheritance tax liability. But that’s not necessarily true.

✔️ UK IHT still applies if you remain UK-domiciled (typically 40% tax on estates over £325,000).

✔️ Greek IHT applies to Greek assets (rates between 1%–40%).

✔️ Double taxation risk exists if assets are subject to both UK and Greek IHT.

Unlike UK inheritance law (where you can leave your estate to whomever you choose), Greek succession law favours forced heirship.

✔️ Spouses and children automatically inherit a portion of your estate.

✔️ Your will cannot override Greek inheritance laws for local assets.

💡 How to Work Around This?

✔️ Hold assets via a trust, company, or offshore structure.

✔️ Have a UK will and a separate Greek will covering only your Greek assets.

If you own property in the UK, you need to consider:

✔️ Selling Before Moving? You may owe UK Capital Gains Tax (CGT) if you sell after becoming a Greek tax resident.

✔️ Renting it Out? UK rental income remains taxable in the UK, but you must also declare it in Greece.

💡 In addition, bear in mind that being a landlord in the UK is increasingly difficult (regulations, taxes, etc.) and these challenges are exacerbated when dealing with them from another country.

Since you’ll likely be drawing a pension in GBP but spending in EUR, currency fluctuations can impact your retirement income.

🔹 A weakening GBP reduces spending power in Greece.

🔹 Unpredictable FX rates can reduce pension value.

💡 Solutions to Reduce Risk

✔️ Use multi-currency accounts (Revolut, Wise) for flexibility.

✔️ Set up automatic currency hedging strategies.

✔️ Consider regular transfers using FX brokers to lock in better rates.

Unlike the UK, the Greek tax year is between January 1st and December 31st.

Yes.

Yes, but some UK banks may close accounts for non-UK residents. Consider using international banks or multi-currency accounts like Wise or Revolut.

No, the UK-Greece tax treaty prevents double taxation. However, you must apply for a UK No Tax (NT) tax code.

Final Thoughts: Planning a Tax-Efficient Retirement in Greece

Retiring in Greece can be financially rewarding if structured correctly. Before making the move, ensure that you:

✔️ Optimize your pension withdrawals to take advantage of the UK’s tax-free lump sum rules and Greece’s 7% pension tax rate.

✔️ Plan for UK-Greece tax residency issues – avoid double taxation and maximise tax efficiency.

✔️ Structure your estate planning effectively to minimise inheritance tax exposure in both countries.

Want Expert Guidance on Your Greek Retirement?

Navigating pensions, tax, and estate planning as an expat is complex.

If you’re planning to retire in Greece and want to ensure your wealth is structured tax-efficiently, book a consultation today.

Ross is a qualified Chartered Financial Planner and Pension Transfer Specialist.

He has been a cross-border financial adviser for 25 years and specialises in helping British expats manage their finances with clarity and peace of mind.

If you would like to have a no strings chat with him, please get in touch.