Financial planning for expat women

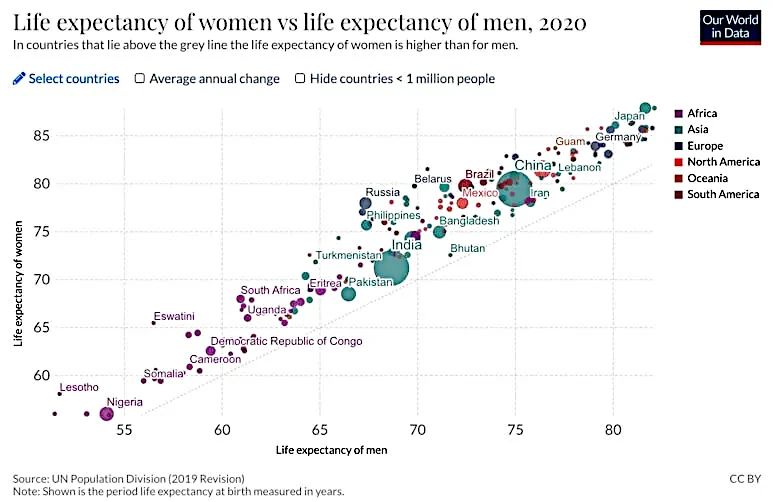

Did you know that women typically live longer than men?

This fact applies irrespective of nationality.

In the UK, the difference in life expectancy is almost 4 years.

Less time working

Women also tend to have much shorter working tenures than men, which means less time to build up retirement funds.

This is particularly the case when a promising career has been put on hold as a family embarks on the magical expat mystery tour.

They often juggle multiple responsibilities and are more likely to face career interruptions due to childcare, caring for ageing parents or providing other family assistance.

More likely to live alone in later years

Finally, women are much more likely to live alone when they are older.

Statistics show that only 18% of women aged 85 or older are still married. For comparison, 58% of men over age 85 still have a partner who is living.

As a result of this, women tend to spend considerably more on care in old age. According to one source I came across, they need to spend three times more.

These all add up to a fairly daunting triple-whammy of financial issues.

Other factors

There are some other interesting points that I have observed when it comes to expat women and personal finance:

- While the gender pay gap still exists, the International Labor Organization recently pegged it at 22%, it is diminishing. Especially for younger generations. In addition, globally, women now outnumber men in universities.

- Women tend to accumulate lower entitlements to state pension due to being out of the labour force for longer and often have much less saved in personal or employer pension schemes.

- Defined benefit pension scheme payments typically reduce by 33-50% to surviving spouses on the death of the member. If the surviving spouse subsequently remarries, payments tend to stop completely.

- Women are often much less involved when it comes to financial planning, e.g. for retirement, and less aware of how the family money is invested and how accounts are managed.

- Research shows that nearly three-quarters of women don’t know how much they need to save for retirement, compared to 52 per cent for men.

- Women are generally more risk-averse than men when it comes to investing. In light of the typically longer female lifespan, this risk aversion may cause many women to miss out on superior long-term returns on their investments. In reality, longer life expectancy should lead to a higher risk tolerance, not lower.

- The balance of wealth is shifting. For example, a higher percentage of the UK’s wealth is now held by women (largely due to divorce and greater longevity).

5 financial action points for expat women

1. Develop a clear idea of what you want in life. What are you saving towards? Prioritise your financial goals as early as possible.

2. Even if you are not working, you can (and should) make voluntary National Insurance Contributions to build up your own UK state pension entitlement. Read how here.

3. Be involved in financial planning. Meet and get to know the family financial adviser. Proactively discuss financial topics with your partner. Understand the financial plans (e.g. pensions) that are already in place.

4. If you are a mother, make sure that you have life insurance, even if you aren’t currently working. This is often neglected as people mistakenly think that only the person earning an income should have their life insured.

5. Ensure that your documents reflect your current circumstances and build an in case of death folder. Make sure that your partner has such a folder too.

Ross is a qualified Chartered Financial Planner and Pension Transfer Specialist.

He has been a cross-border financial adviser for 25 years and specialises in helping British expats manage their finances with clarity and peace of mind.

If you would like to have a no strings chat with him, please get in touch.